The stock market is always full of talks and speculation, especially when it comes to small-cap companies that deliver big returns. Among them, Hazoor Multi Projects has caught the eye of many retail investors. Once a lesser-known name, this company has seen a sharp rise in its share price, making people curious about its future growth and whether it’s a good investment.

In this blog, we take a close look at the Hazoor Multi Projects share price, going through its recent performance, future targets, and all the important things you need to know about Hazoor Multi Projects share.

Table of Contents

ToggleWhat is Hazoor Multi Projects Share?

Hazoor Multi Projects Ltd. is a small-cap company engaged primarily in the real estate development and infrastructure sector. Founded in the early 1990s, the company’s business model focuses on executing large infrastructure projects such as road development, civil engineering contracts, and government collaborations. As per Groww , Hazoor Multi Projects ongoing project include Samruddhi Mahamarg and Rehabilitation and Upgradation of Wakan-Pali-Khopoli.

The company’s credibility has grown over the years due to its association with various road construction tenders and contracts across Maharashtra and other states. Though still small in size compared to giants like IRB Infra or KNR Constructions, Hazoor Multi Projects share has seen recent growth that has turned heads in the market.

Hazoor Multi Projects Share Price History

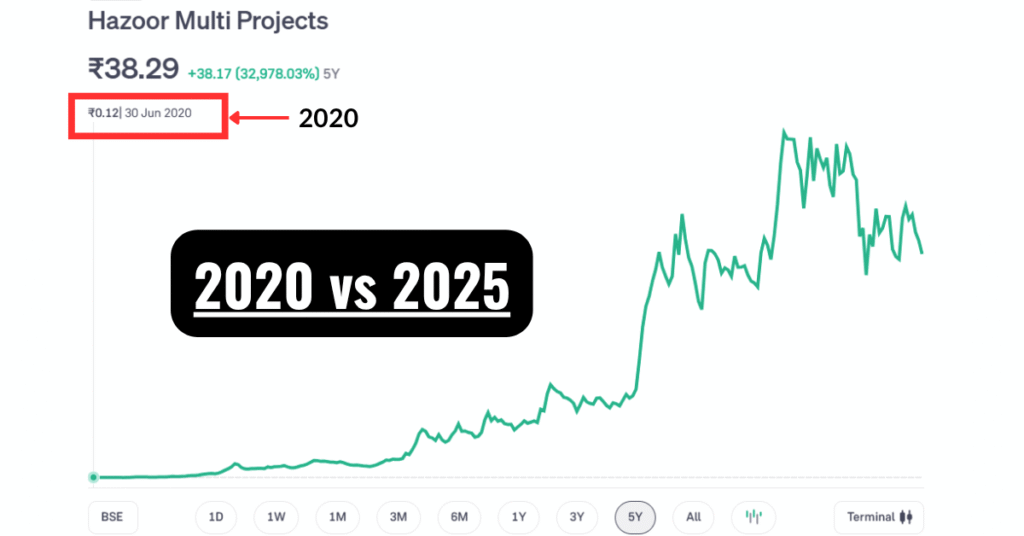

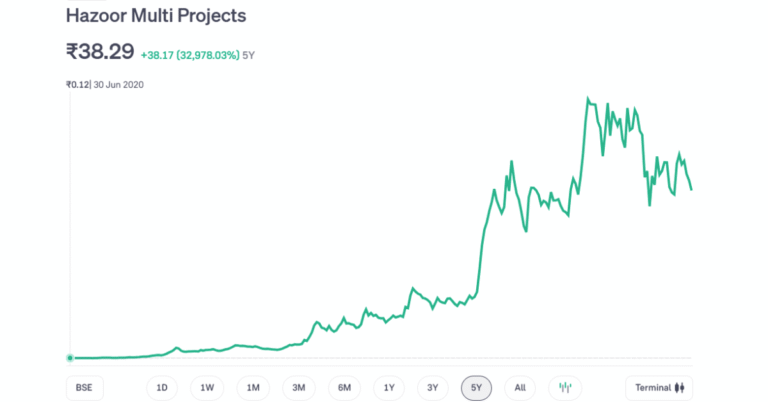

The historical price movement of Hazoor Multi Projects share tells an interesting story. Just a few years back, Hazoor Multi Project share price was trading at a fraction of its current price. In 2020, the stock was available in the single-digit price range. Back then, very few investors had even heard of the company.

The momentum started picking up in 2021, when the company announced key partnerships and secured significant contracts. The share price reacted quickly to these developments and entered a strong upward trajectory. By 2025, the share had delivered multi-fold returns. As shown in the chart above, the returns over the last five years have been remarkable.

Anyone who had invested ₹10,000 in Hazoor Multi Projects share price five years ago would be sitting on around ₹33,00,000 today. Hazoor Multi Projects share has become the second most profitable stock in the last five years, just after Elcid Investment.

Today, the Hazoor Multi Projects share price is being closely tracked by investors, analysts, and market watchers alike. While early investors have already enjoyed massive gains, the big question now is—can this growth continue in the years to come?

Hazoor Multi Projects Share Price Today

As of the latest update, the Hazoor Multi Projects share price is trading near the Rs. 39 mark on the BSE. The stock has shown high volatility, with frequent upper circuits and heavy trading volume, indicating active interest from investors.

This surge in price can be attributed to a mix of fundamental growth and market speculation. Retail participation has also played a key role, especially through platforms like Zerodha and Groww where small-cap tracking has become mainstream.

Despite its high current valuation compared to previous years, many investors believe that Hazoor Multi Projects still has a long way to go due to the increasing infrastructure push by the Indian government.

Hazoor Multi Projects Share Price Target 2025

Given the strong momentum and sectoral tailwinds, many analysts have started providing future targets for Hazoor Multi Projects. By 2025, conservative estimates place the target price around Rs. 100 to Rs. 150, provided the company continues its current growth trajectory.

Here are some factors influencing this 2025 target:

- Project Pipeline: The company has a strong pipeline of infrastructure projects, especially in Maharashtra.

- Government Policies: Continued government investment in roads and highways.

- Improved Financials: If earnings and margins improve consistently, it could justify higher valuations.

- Retail Interest: The growing attention from retail investors can lead to better liquidity and demand.

While the target price for 2025 is promising, it’s essential to consider the risks involved with small-cap stocks, including volatility and management execution.

You may also like to read: IRFC Share Price Target: 2025

Hazoor Multi Projects Share Price Target 2030

Looking even further ahead, long-term investors are keen on knowing the potential of Hazoor Multi Projects by the year 2030. Assuming consistent execution, a steady flow of new contracts, and sectoral support, many forecasts place the share price target.

Reasons for optimistic 2030 targets include:

- Compounding Growth: If the company grows earnings at 20–25% annually, the stock could multiply over time.

- Infra Boom: India’s focus on building infrastructure by 2030 under schemes like Gati Shakti could benefit companies like Hazoor.

- Diversification: Any diversification into new revenue segments like smart cities or renewable energy infra could unlock more value.

However, it’s critical to stay updated with quarterly earnings and monitor any changes in government policy or macroeconomic conditions that could affect growth.

Hazoor Multi Projects Financial Performance

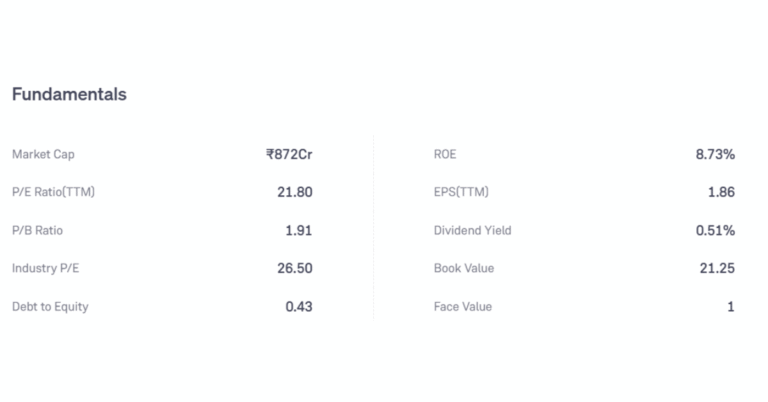

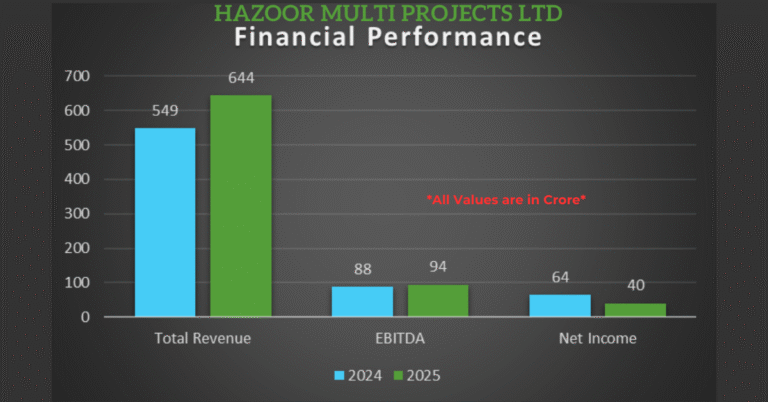

A deeper look into the company’s financial statements reveals a mixed picture. While historical financial data for Hazoor Multi Projects is limited and not easily available in the public domain, recent figures for 2024 and 2025 provide a clear picture of the company’s current performance and growth. These numbers highlight how the company has developed in the short term and give us an idea of its strengths and challenges.

In 2024, the company reported a total revenue of ₹549 crore, which increased to ₹644 crore in 2025. This represents an impressive growth of ₹95 crore, or approximately 17% year-over-year, indicating strong business momentum—likely driven by new contracts and expanding infrastructure activities.

Meanwhile, EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), which measures core operational profitability, grew from ₹88 crore in 2024 to ₹94 crore in 2025. This represents a more modest growth rate of about 6.8%, indicating that while operations are expanding, costs may also be increasing. Nevertheless, it’s still a positive sign that the business is operating smoothly

Even though the company’s revenue and EBITDA (a measure of earnings before interest, taxes, depreciation, and amortization) have gone up, the net profit has actually gone down. The net profit dropped from ₹64 crore in 2024 to ₹40 crore in 2025, which is a significant decrease of 37.5%.

In short, while the company is growing in some areas, the decline in profit indicates it’s facing challenges in controlling costs or managing its finances efficiently. As an investor, it’s crucial to understand whether these issues are temporary or part of a longer-term trend. Keeping track of the company’s ability to improve its cost structure and efficiency will be key in determining if it’s a good investment going forward.

Investors should also note that Hazoor operates in a capital-intensive sector, meaning periodic borrowing for new projects is expected. The key to success lies in effective project execution and timely revenue realization.

Hazoor Multi Projects Share Price in 2020 vs Today

Back in 2020, Hazoor Multi Projects share was an unnoticed penny stock trading under Rs. 1. Today, in 2025, it has multiplied many times over, now hovering around Rs. 39.

This journey represents:

- Growth of over 32978% in just 4–5 years.

- Increased visibility and credibility in the infra space.

- A classic case of a penny stock transforming into a mid-cap contender.

Many early investors consider this a multi-bagger success story, but it’s crucial to understand that such growth stories also come with high risk. For new investors, the question is not just about past performance, but whether future returns can still be significant.

Bonus and Corporate Action History

As of now, Hazoor Multi Projects has not declared any bonus shares or stock splits in the recent past. However, if the share price continues its upward trend, the management may consider such actions in the future to improve liquidity.

Keeping an eye on corporate announcements is vital, especially for long-term investors. Any changes like bonus shares, rights issues, or dividends can significantly affect shareholding value and market sentiment.

Is Hazoor Multi Projects a Good Buy?

Now comes the most common question: Is Hazoor Multi Projects share a good buy at current levels?

Let’s weigh the pros and cons:

Pros:

- Strong sectoral presence in infrastructure.

- Healthy project pipeline.

- Improving financials and profitability.

- Increased market visibility.

Cons:

- High valuation based on past returns.

- Execution risks typical of infra companies.

- Relatively low institutional holding.

Investors with a high-risk appetite and a long-term horizon might consider it, but caution is advised. It’s always better to invest after thorough research or consultation with a financial advisor.

Expert Analysis and Future Outlook

Market experts believe that Hazoor Multi Projects has positioned itself well in India’s infrastructure growth story. The firm’s ability to win state and national-level tenders has impressed analysts, even though the company is relatively small.

However, future performance depends heavily on execution capabilities, government policy continuity, and macroeconomic stability.

Long-term investors can consider it a potential multibagger, but must be ready for high short-term volatility.

Target Prices view on Hazoor Multi Projects Share

Hazoor Multi Projects share price has shown an extraordinary journey from a penny stock to a fast-growing infra company. With ambitious targets for 2025 and 2030, the stock continues to attract investor attention. However, it’s crucial to approach this opportunity with a long-term view and informed judgment.

As India’s infrastructure story continues to unfold, Hazoor Multi Projects may emerge as a key player—making it a company worth watching closely in the years ahead.

Disclaimer: We do not recommend buying any stocks. We want to make it clear that we are not licensed to give financial advice. The information we provide comes from trusted sources and is meant for educational purposes only. The target prices are based on calculations from past data and predictions, not guarantees. We encourage readers to do their own research before making any financial decisions. We are not responsible for any losses or damages that may occur if someone makes a financial decision based on our information.

FAQs

1. What is Hazoor Multi Projects share price today?

As of June 2025, it is trading around Rs. 39 on the BSE.

2. What is the share price target for Hazoor in 2025?

Analysts expect a target of Rs. 100–150 by 2025.

3. What is the long-term target for 2030?

Forecasts suggest Rs. 800–1000 depending on execution and sector performance.

4. Is Hazoor Multi Projects a good investment?

It has high potential but comes with risk. Ideal for long-term investors with high-risk tolerance.

5. Has Hazoor issued bonus shares or dividends?

You can track it on platforms like BSE India, Screener.in, and brokerage apps.