The Financial year 2025 brings fresh opportunities and renewed enthusiasm for investors and market watchers. As we step into a new phase, many of us are eager to identify potential stock targets and plan our investments accordingly.

One company drawing significant attention is Indian Railway Finance Corporation (IRFC), we will discuss IRFC SHARE PRICE TARGET: Detailed Analysis As On 2025. But can it live up to investors’ expectations? Does it have the potential to become a multi-bagger stock, much like Titan, which transformed the fortunes of many, including the late legendary investor, Rakesh Jhunjhunwala?

In this article, we will explore IRFC’s target price for 2025, analyse its current performance, and discuss the key factors that could drive its stock price higher in the coming year.

Table of Contents

ToggleIRFC Share Price Target: Profile

- Full Name: Indian Railway Finance Corporation Limited (IRFC)

- Industry: Financial Services

- Headquarters: New Delhi, India

- Founded: 1986

- Parent Company: Indian Railways

- Stock Ticker: IRFC is listed on the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) in India.

- Main Activity: IRFC raises funds from the market through bond issuances and loans to Indian Railways for its infrastructure and rolling stock needs.

- Purpose: To finance the development and modernization of Indian Railways and its projects.

IRFC Share Price Target: Recent Data

Okay, now you can quickly access the recent key numbers for IRFC shares. The current price of IRFC shares is INR 146.40, and as you can see in the table below, its 52-week low is INR 108.04, while its 52-week high is INR 229. These numbers are essential for getting a quick snapshot of a share’s recent performance.

Current Price as on 06th June, 2025 | INR 146.40 |

52 Week low | INR 108.04 |

52 Week high | INR 229 |

IRFC Share Price Target: Overview

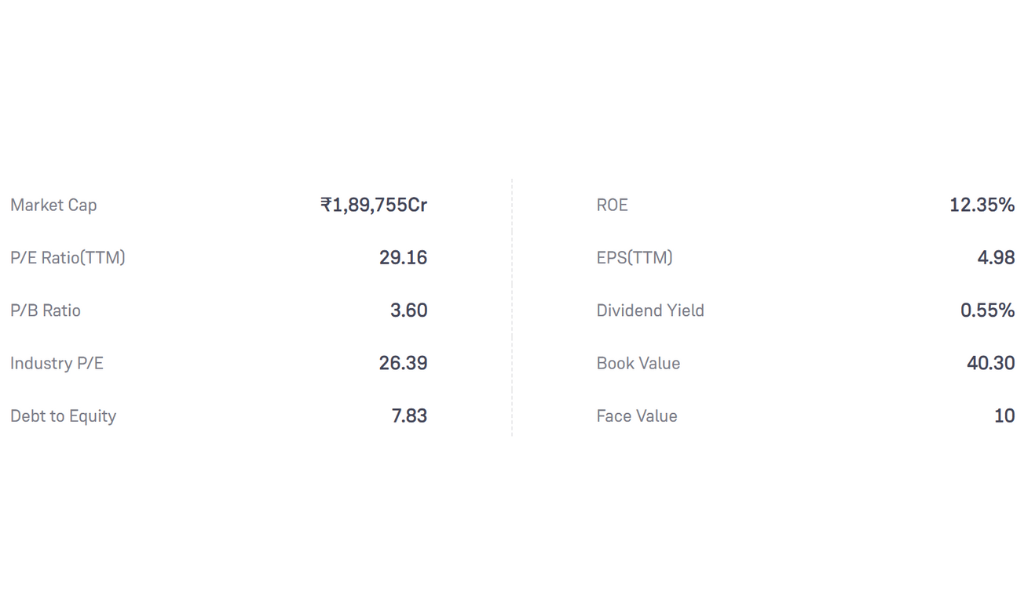

Let’s begin with the basic financial information on IRFC shares for your quick reference. I have provided the key data in one place.

The current price of Indian railway Finance Corporation (IRFC) is INR 146.4 and IRFC has a market capitalization of ₹1,89,755 crore, making it a large-cap stock. In India, any company with a market cap above ₹50,000 crore is classified as large-cap. These stocks are generally more stable and preferred for long-term investments.

The Price-to-Earnings (P/E) ratio for IRFC is 29.16, meaning investors are willing to pay ₹29.16 for every ₹1 the company earns. This is slightly higher than the sector P/E ratio, indicating that IRFC is valued similarly to its peers.

A higher P/E often suggests that investors expect strong future growth. However, it’s also important to check Earnings Per Share (EPS), which stands at ₹5.00. A steady increase in EPS over time is a good sign of a company’s profitability.

The Price-to-Book (P/B) ratio of 3.60 means IRFC’s stock price is trading at 3.5 times its book value. The book value per share is ₹40.30, which represents the company’s actual net worth per share. If a stock’s market price is much higher than its book value, investors may be expecting future growth.

IRFC has a Debt-to-Equity ratio of 7.83, meaning it relies heavily on borrowed funds. This is common for financing companies, but high debt levels should always be monitored.

Despite the high debt, IRFC maintains a Return on Equity (ROE) of 12.35%, meaning for every ₹100 invested by shareholders, the company generates ₹12.35 in profit. A good ROE suggests that IRFC is effectively using shareholder funds to generate earnings.

IRFC offers a dividend yield of 0.55%, meaning investors earn ₹0.55 in dividends for every ₹100 invested. While not extremely high, it provides a steady return in addition to potential stock appreciation.

The face value of IRFC shares is ₹10, which is just the nominal value used for accounting purposes and does not impact market price.

Quick Access Table

Metric | Value | Meaning |

Market Cap | ₹1,89,755 Cr | Large-cap stock, stable for long-term investing. |

P/E Ratio (TTM) | 29.16 | Investors pay ₹29.16 for every ₹1 of earnings. |

Industry P/E | 26.39 | IRFC’s valuation is similar to industry peers. |

EPS (TTM) | 5.00 | Profit per share. |

P/B Ratio | 3.5 | Stock is trading at 3.5 times its book value. |

Book Value | 40.30 | Shows the actual asset value per share. |

Debt to Equity | 7.83 | High debt, common for financing companies. |

ROE | 12.35% | ₹12.35 profit per ₹100 of shareholder funds. |

Dividend Yield | 0.55% | ₹0.55 dividend per ₹100 invested. |

Face Value | 10 | Nominal stock value, used for accounting. |

IRFC is a large-cap stock with a fair valuation compared to the industry. It has high debt, which is expected for a financing company, but it also maintains a healthy return on equity (ROE) and steady dividend payouts. Investors looking for a stable, long-term investment with a consistent revenue model may find IRFC an attractive option.

Also Read: Basic Stock Market terms: You should not avoid in 2025.

IRFC Share Price Target: Shareholding Pattern

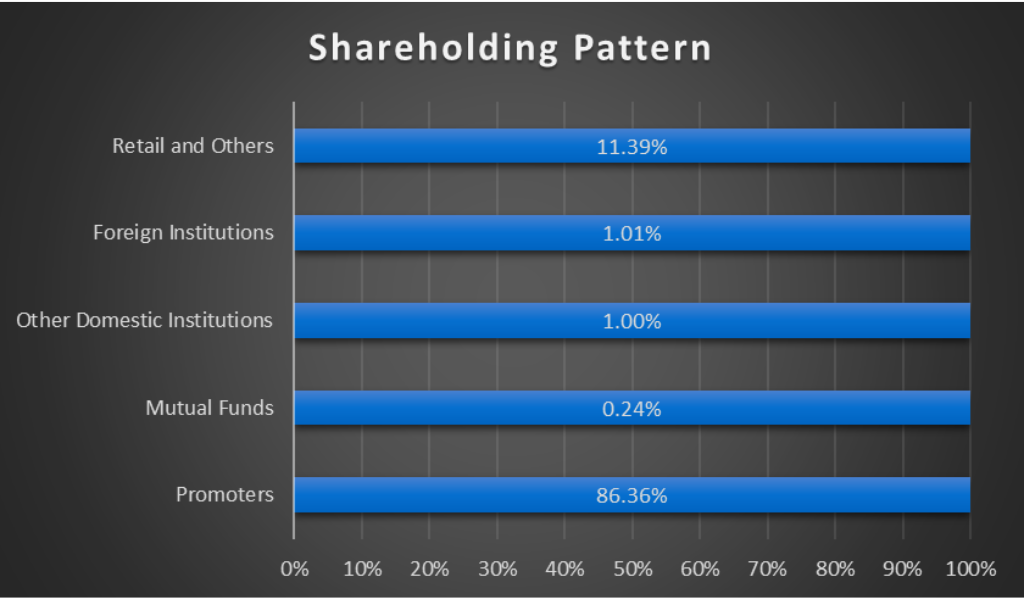

If we look at the shareholding pattern of IRFC as of December 2024, promoters are the major stakeholders, holding 86.36% of the company. They are followed by retail investors and others, who hold a stake of 11.39%.

Domestic and foreign institutions have shown little interest in IRFC shares, with foreign institutions holding just 1.01% and other domestic institutions at 1.00%.

Among all investor categories, mutual funds have the least involvement, holding only 0.24%, making them the least interested party in this structure.

IRFC Share Price Target: Financial Data

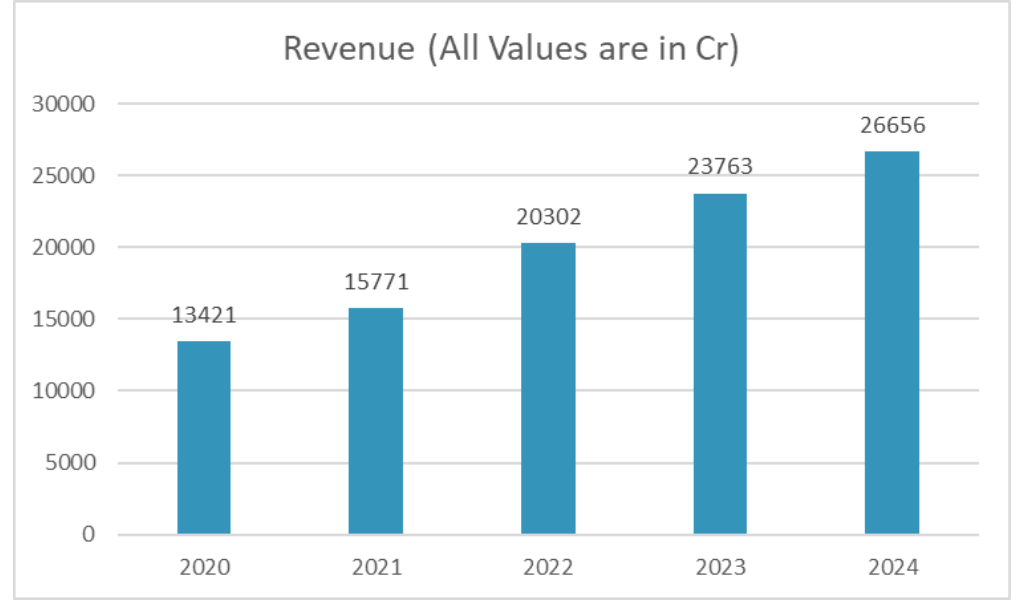

Let’s have a look at the revenue of IRFC. It has been earning more money every year. In 2020, it made ₹13,421 crore, and by 2024, that number doubled to ₹26,656 crore. This shows the company is growing steadily and doing well in its main job — giving loans to Indian Railways.

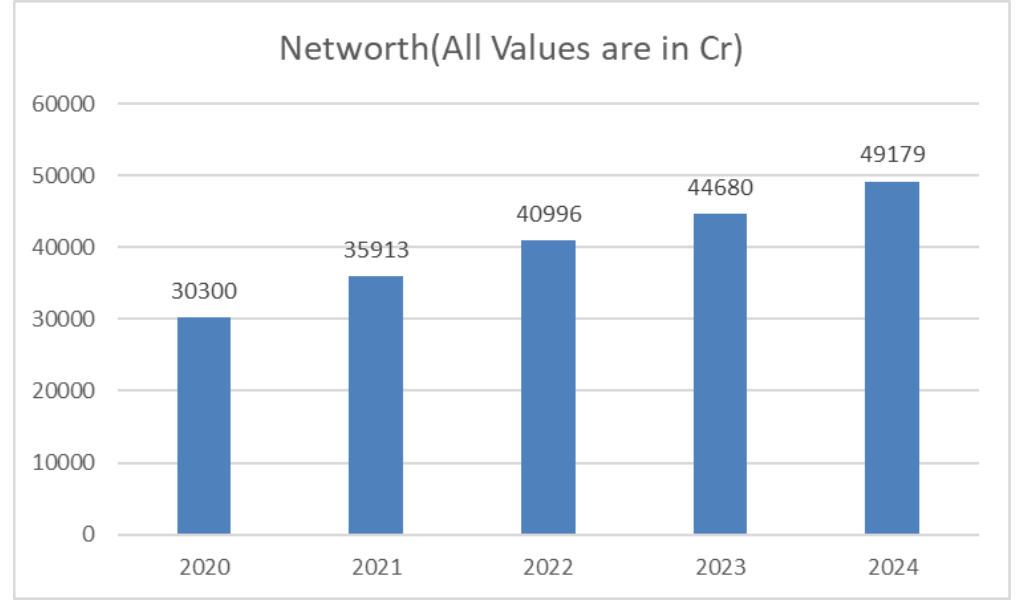

The total Net worth value of the company has gone up a lot in the last five years — from ₹30,300 crore in 2020 to ₹49,179 crore in 2024. This means IRFC is becoming stronger financially and is in a good position to support more railway projects in the future.

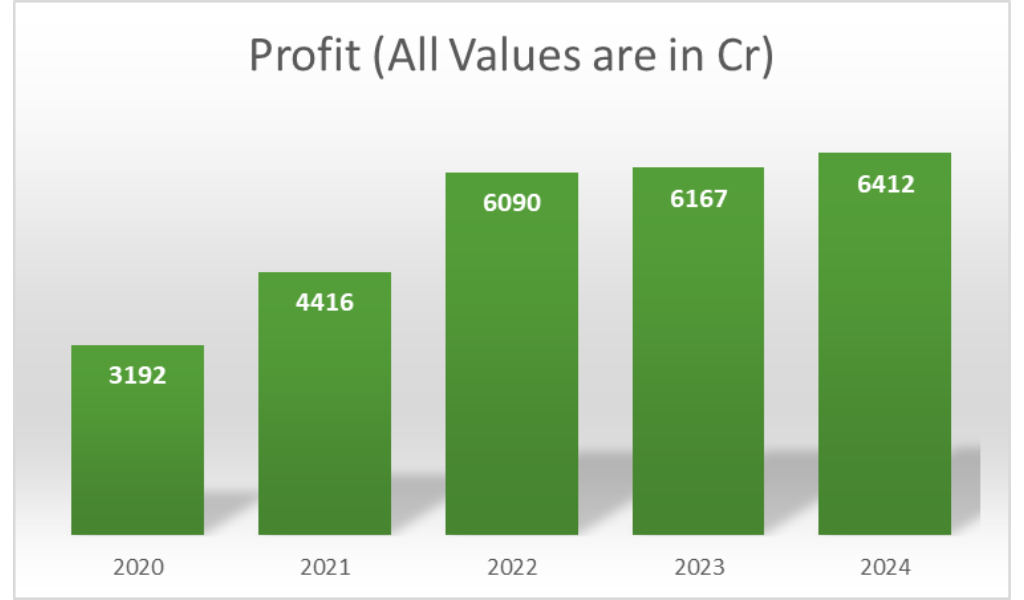

IRFC’s profit — the money it keeps after all expenses — has also gone up nicely. In 2020, it made ₹3,192 crore in profit, and by 2024, that grew to ₹6,412 crore. This shows the company is not just earning more, but also managing its money well.

IRFC Share Price Target: 2025, 2026, 2027, 2028, 2029, 2030.

Finally, we’ve reached the most awaited part of this blog — yes, you guessed it right! Let’s talk about where IRFC’s share price could be heading in the next few years — 2025, 2026, 2027, 2028, 2029, and even 2030.

Disclaimer: We do not recommend buying any stocks. We want to make it clear that we are not licensed to give financial advice. The information we provide comes from trusted sources and is meant for educational purposes only. The target prices are based on calculations from past data and predictions, not guarantees. We encourage readers to do their own research before making any financial decisions. We are not responsible for any losses or damages that may occur if someone makes a financial decision based on our information.

IRFC Share Price Target for 2025

The year 2025 is expected to be a turning point for IRFC. The projected share price may fluctuate between ₹119 and ₹189, with an average price sitting somewhere around ₹149.

This suggests a year of gradual growth. Investors who enter early might not see huge returns instantly, but 2025 could lay the groundwork for future momentum.

What It Means:

IRFC is gaining visibility. As India’s railway infrastructure expands and demand for financing increases, IRFC’s role becomes even more significant. This year may reflect growing investor confidence but still remains a foundational phase.

| IRFC Share Price Target 2025 | |

| Month | Expected Value |

| January | INR 140.00 |

| February | INR 126.00 |

| March | INR 119.00 |

| April | INR 128.00 |

| May | INR 141.00 |

| June | INR 148.00 |

| July | INR 157.00 |

| August | INR 159.00 |

| September | INR 164.00 |

| October | INR 178.00 |

| November | INR 183.00 |

| December | INR 189.00 |

IRFC Share Price Target for 2026

Moving into 2026, the IRFC share price target looks more encouraging. It’s expected to range from ₹195 to ₹255 throughout the year. Compared to 2025, this is a strong jump, showing that the market could be rewarding IRFC’s consistency.

What It Means:

By this time, IRFC might start getting more attention not just from individual investors but possibly even from institutional players. As a public sector company with predictable cash flow and strategic importance, IRFC could benefit from broader interest in PSU stocks.

| IRFC Share Price Target 2026 | |

| Month | Expected Value |

| January | INR 195.00 |

| February | INR 203.00 |

| March | INR 211.00 |

| April | INR 219.00 |

| May | INR 231.00 |

| June | INR 233.00 |

| July | INR 230.00 |

| August | INR 235.00 |

| September | INR 241.00 |

| October | INR 244.00 |

| November | INR 249.00 |

| December | INR 255.00 |

IRFC Share Price Target for 2027

In 2027, IRFC shares may reach a new range of ₹257 to ₹311. This may not look like a huge surge, but it reflects stability. After the big jump in 2026, this year might be about building a stronger base.

What It Means:

Investors may start seeing IRFC as a reliable long-term stock rather than a short-term bet. The price movement could be more stable, and this kind of steady growth often attracts conservative, long-horizon investors.

| IRFC Share Price Target 2027 | |

| Month | Expected Value |

| January | INR 257.00 |

| February | INR 264.00 |

| March | INR 262.00 |

| April | INR 269.00 |

| May | INR 273.00 |

| June | INR 276.00 |

| July | INR 283.00 |

| August | INR 286.00 |

| September | INR 293.00 |

| October | INR 297.00 |

| November | INR 306.00 |

| December | INR 311.00 |

IRFC Share Price Target for 2028

IRFC’s share price target for 2028 is forecasted to rise to between ₹321 and ₹394. This indicates continued investor faith, especially if the company keeps delivering strong results and holds its strategic relevance in railway financing.

What It Means:

This could be a rewarding year for those who’ve stayed invested over the past few years. With financial performance likely strengthening, the stock may command more respect in the market and potentially even be considered as a blue-chip candidate in the future.

| IRFC Share Price Target 2028 | |

| Month | Expected Value |

| January | INR 321.00 |

| February | INR 325.00 |

| March | INR 330.00 |

| April | INR 334.00 |

| May | INR 341.00 |

| June | INR 349.00 |

| July | INR 355.00 |

| August | INR 363.00 |

| September | INR 368.00 |

| October | INR 378.00 |

| November | INR 385.00 |

| December | INR 394.00 |

IRFC Share Price Target for 2029

As we approach 2029, IRFC may see its share price move between ₹408 and ₹523. This is a strong leap from its earlier phases, suggesting that IRFC may now be in the spotlight.

What It Means:

At this point, IRFC’s story will likely be widely recognized. With government projects scaling up and consistent dividends (if maintained), this could become a stock that investors talk about in the same breath as other strong-performing PSUs.

| IRFC Share Price Target 2029 | |

| Month | Expected Value |

| January | INR 408.00 |

| February | INR 423.00 |

| March | INR 433.00 |

| April | INR 441.00 |

| May | INR 457.00 |

| June | INR 462.00 |

| July | INR 475.00 |

| August | INR 487.00 |

| September | INR 494.00 |

| October | INR 502.00 |

| November | INR 514.00 |

| December | INR 523.00 |

IRFC Share Price Target for 2030

By 2030, IRFC’s share price target is expected to fall in the range of ₹528 to ₹654. This marks a significant increase over five years — showing how a patient investor could benefit from holding on.

What It Means:

This could be the payoff year. If the company continues on its current path, 2030 might be when long-term investors enjoy substantial returns. IRFC may well evolve into a core part of PSU-heavy portfolios — thanks to both its fundamentals and strategic importance.

| IRFC Share Price Target 2030 | |

| Month | Expected Value |

| January | INR 528.00 |

| February | INR 537.00 |

| March | INR 547.00 |

| April | INR 556.00 |

| May | INR 572.00 |

| June | INR 581.00 |

| July | INR 593.00 |

| August | INR 604.00 |

| September | INR 618.00 |

| October | INR 629.00 |

| November | INR 642.00 |

| December | INR 654.00 |

What Can Impact IRFC Share Price Growth?

As you might be aware, it is hardly possible to predict the long-term growth of a share with certainty. However, it’s important to understand the key factors that can influence its price in the future. Here are some important points to keep in mind

1.Company Performance

IRFC’s profits, income, and overall financial health are big drivers of its share price. If the company earns more money and manages its expenses well, the stock is likely to do better.

2.Government Support

Since IRFC is owned by the government and mainly funds Indian Railways, any increase in railway spending (like for new trains, stations, or tracks) can help IRFC grow.

3. Interest Rates

IRFC borrows money to give loans to the railways. If interest rates go up, its borrowing costs increase, which can reduce its profits. Lower rates can be good for the company.

4. Railway Budget & Policies

Every year, the government announces a railway budget. If it plans to spend more on infrastructure, IRFC gets more business. Changes in government policies or leadership can also impact future growth.

5. Stock Market Sentiment Toward PSU Stocks

IRFC is a public sector undertaking (PSU), and investor interest in PSU stocks can rise or fall based on the market’s mood and government reforms.

6. Dividends

IRFC gives regular dividends, which attracts long-term investors. A strong or increasing dividend can make the stock more attractive.

7. Credit Ratings

If credit agencies give IRFC a good rating, it means the company is financially stable, and that can boost investor confidence.

8. Economic Conditions

Factors like inflation, GDP growth, and government spending influence how companies perform. A strong economy usually supports business growth.

9. Global Factors

Foreign investor interest, global economic trends, or geopolitical tensions can also affect Indian markets, including IRFC’s share price.

IRFC Share Price Target: FAQ

What is the IRFC share price target for 2025?

IRFC’s 2025 share price is projected to range between ₹119 and ₹189, indicating gradual growth with an average around ₹149.

What is the long-term IRFC share price target by 2030?

By 2030, IRFC’s share price is expected to reach between ₹528 and ₹654, offering strong potential for long-term investors.

Who are IRFC's peer companies in the market?

IRFC’s peers include PFC, REC, RVNL, HUDCO, IREDA, as well as IFCI and Tourism Finance Corporation of India — all key players in infrastructure or railway-related financing.

Is IRFC a good buy in the long term?

According to experts, it is a large-cap PSU stock, and one can consider investing in it with the expectation of stable growth in the long run.”

That’s all from the post.

But I’d love to hear what you think about IRFC share target price? Do you agree or have a different perspective?

Also, if there’s anything I missed or any suggestions for how I can improve the post, feel free to share in the comments below. Your feedback means a lot and helps me provide better content. Looking forward to reading your thoughts!

Pingback: Hazoor Multi Projects Share Price Target 2025, 2030 - Target Prices

Pingback: NHPC Share Price Target 2025, 2030 & 2040 | Target Overview