If you’re an investor looking for stable returns, low volatility, and consistent dividends, then NHPC Limited might be a hidden gem in the Indian stock market. In this blog, we’ll take a closer look at the NHPC share price target for 2025 to 2030, and also take a quick look at its possible price by 2040.

Table of Contents

ToggleWhat is NHPC?

NHPC Limited (National Hydroelectric Power Corporation) is a PSU under the Ministry of Power. Its core business is generating hydroelectricity, but it is also investing in solar energy, wind energy, and battery storage.

For more detailed information about the company background, you visit the official website of NHPC Limited.

Let’s take a quick look at the below table for the important figures of NHPC Ltd.

Recent Performance

Key Detail | Value |

Current Price | ₹84.90 |

Market Cap | ₹85,390 Crore |

52-Week High | ₹118.40 |

52-Week Low | ₹71.00 |

Dividend Yield | 3 % (Approximate) |

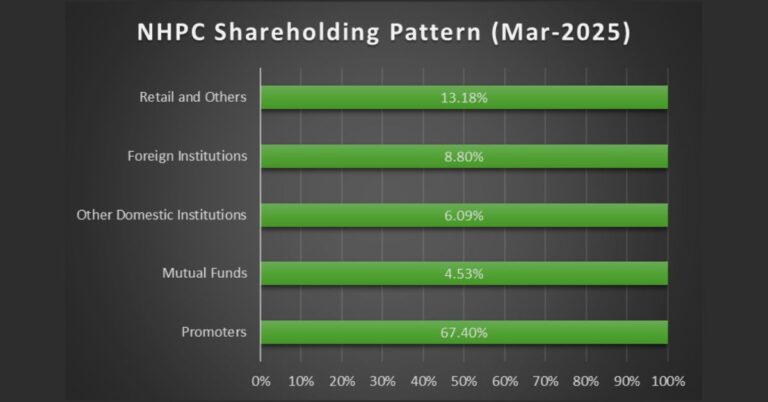

Shareholding Pattern

The chart below shows the latest shareholding pattern of NHPC Limited as of March 2025:

NHPC Share Price Target till 2040

The table below shows where NHPC’s share price could be heading each year from 2025 to 2030, based on market trends, growth potential, and expert analysis. For each year, there are three levels of targets:

✅ Minimum Target – A conservative estimate, assuming slow growth or weaker market conditions.

📊 Average Target – A realistic, middle-ground estimate based on expected performance.

🚀 Maximum Target – An optimistic estimate, assuming strong growth and favorable market conditions.

Year | Minimum Target | Average Target | Maximum Target |

2025 | ₹88 | ₹95 | ₹105 |

2026 | ₹100 | ₹112 | ₹125 |

2027 | ₹115 | ₹128 | ₹150 |

2028 | ₹130 | ₹145 | ₹173 |

2029 | ₹145 | ₹160 | ₹195 |

2030 | ₹160 | ₹180 | ₹216 |

NHPC Share Price Target Comparison – 2025 vs 2030 vs 2040

Now that you’ve seen the table above, let’s take a quick look at this bar chart showing how NHPC’s share price could look in 2025, 2030, and 2040 based on current projections.

Now that we’ve gone through the yearly share price targets for NHPC up to 2030—and taken a quick forecast comparison for 2025, 2030, and 2040—let’s take it a step further. In the next section, we’ll break down month-wise target prices for each year to give you a clearer idea of how the stock might move in the short term.

We’ll also discuss how NHPC’s share price could grow by 2040, giving you a long-term perspective based on the company’s future plans, government policies, and India’s clean energy goals.

Whether you’re a short-term trader or a long-term investor, this detailed outlook will help you understand where NHPC might be headed—and why it could be worth watching.

You might also like to read our detailed analysis on IRFC share price target 2025–2030, where we cover another promising PSU with strong long-term potential.

Disclaimer: We do not recommend buying any stocks. We want to make it clear that we are not licensed to give financial advice. The information we provide comes from trusted sources and is meant for educational purposes only. The target prices are based on calculations from past data and predictions, not guarantees. We encourage readers to do their own research before making any financial decisions. We are not responsible for any losses or damages that may occur if someone makes a financial decision based on our information.

NHPC Share Price Target 2025

Month | Price Range (₹) |

January | ₹76 – ₹80 |

February | ₹78 – ₹82 |

March | ₹79 – ₹85 |

April | ₹80 – ₹88 |

May | ₹82 – ₹90 |

June | ₹83 – ₹92 |

July | ₹84 – ₹95 |

August | ₹85 – ₹96 |

September | ₹86 – ₹98 |

October | ₹88 – ₹100 |

November | ₹90 – ₹103 |

December | ₹92 – ₹105 |

In 2025, NHPC is expected to recover from its 2024 correction. The stock started the year on a cautious note, but gradually moved up as confidence returned to PSU stocks. Investors may see NHPC slowly climbing from around ₹76 in January to ₹105 by December 2025 if dividend payouts continue and PSU sentiment stays positive.

NHPC Share Price Target 2026

Month | Price Range (₹) |

January | ₹95 – ₹100 |

February | ₹97 – ₹103 |

March | ₹98 – ₹105 |

April | ₹100 – ₹108 |

May | ₹102 – ₹110 |

June | ₹104 – ₹112 |

July | ₹106 – ₹115 |

August | ₹108 – ₹117 |

September | ₹110 – ₹118 |

October | ₹112 – ₹120 |

November | ₹113 – ₹123 |

December | ₹115 – ₹125 |

2026 could be a breakout year for NHPC. The company’s investment in solar and pumped hydro storage may start showing results, attracting more attention from institutions and retail investors. Starting the year around ₹95, NHPC may gradually rise to ₹125 by year-end — supported by strong earnings and a stable policy environment.

NHPC Share Price Target 2027

Month | Target Price Range (₹) |

January | ₹118 – ₹125 |

February | ₹120 – ₹127 |

March | ₹122 – ₹129 |

April | ₹124 – ₹132 |

May | ₹126 – ₹134 |

June | ₹128 – ₹136 |

July | ₹130 – ₹138 |

August | ₹132 – ₹140 |

September | ₹134 – ₹142 |

October | ₹135 – ₹144 |

November | ₹137 – ₹146 |

December | ₹140 – ₹150 |

By 2027, NHPC is expected to be recognized as a clean energy leader among PSUs. With multiple green energy projects either commissioned or nearing completion, the stock could benefit from rerating. Prices could start near ₹118 in January and potentially touch ₹150 by December — especially if dividend yields stay high and renewable revenues flow in.

NHPC Share Price Target 2028

Month | Target Price Range (₹) |

January | ₹143 – ₹150 |

February | ₹145 – ₹152 |

March | ₹147 – ₹154 |

April | ₹148 – ₹156 |

May | ₹150 – ₹158 |

June | ₹152 – ₹160 |

July | ₹154 – ₹162 |

August | ₹156 – ₹165 |

September | ₹158 – ₹167 |

October | ₹160 – ₹169 |

November | ₹162 – ₹171 |

December | ₹164 – ₹173 |

In 2028, NHPC is projected to enter a mature growth phase. Earnings may become more predictable and consistent, helping the stock steadily move between ₹143 and ₹173 through the year. The market may reward NHPC for its clean energy capacity, regular dividend payouts, and stable financials.

NHPC Share Price Target 2029

Month | Target Price Range (₹) |

January | ₹165 – ₹172 |

February | ₹167 – ₹174 |

March | ₹169 – ₹176 |

April | ₹171 – ₹178 |

May | ₹173 – ₹180 |

June | ₹175 – ₹182 |

July | ₹177 – ₹184 |

August | ₹178 – ₹186 |

September | ₹180 – ₹188 |

October | ₹182 – ₹190 |

November | ₹183 – ₹192 |

December | ₹185 – ₹195 |

By 2029, NHPC is expected to be an established green energy giant within the PSU space. With multiple income sources (hydro, solar, hybrid), it could become a favorite for conservative portfolios. Starting around ₹165, the share could grow to ₹195 by year-end. If interest rates remain stable and power demand increases, NHPC may continue its upward climb.

NHPC Share Price Target 2030

Month | Target Price Range (₹) |

January | ₹188 – ₹195 |

February | ₹190 – ₹197 |

March | ₹192 – ₹199 |

April | ₹193 – ₹200 |

May | ₹194 – ₹202 |

June | ₹196 – ₹204 |

July | ₹198 – ₹206 |

August | ₹200 – ₹208 |

September | ₹202 – ₹210 |

October | ₹204 – ₹212 |

November | ₹206 – ₹214 |

December | ₹208 – ₹216 |

2030 could be the year when NHPC truly delivers long-term compounding benefits. If the company executes well, maintains margins, and India meets its renewable goals, NHPC might grow from ₹188 in January to ₹216 in December. This marks a significant milestone — nearly 2.5x from its 2025 lows.

NHPC Share Price Target 2040

By the year 2040, NHPC’s share price could grow to somewhere between ₹350 and ₹480. This means if the company continues to perform well, its stock might become 4 to 5 times more valuable than today.

Why could this happen? The Indian government is working toward becoming a net-zero carbon country by 2070. That means a big focus on clean energy—like solar, wind, and hydro power.

Another good thing about NHPC is that it pays regular dividends—a small extra income for investors, even if they don’t sell their shares. And because it’s a government-owned company (PSU), it’s considered more stable and safe, especially during tough times in the market.

Of course, no investment is risk-free. Big projects can get delayed, and sometimes government rules can affect profits. But for someone looking to invest for the long term, NHPC could be a smart and steady choice that offers both growth and income.

Our Take on NHPC Share Price Target

Based on current trends and company direction, NHPC seems well-positioned for long-term growth. It’s not without risks, but for patient investors, it offers a compelling balance of income and capital appreciation.

If you believe in India’s clean energy future, this PSU could help you ride the wave all the way till 2040!

If you’re also exploring high-growth penny stocks, check out our in-depth analysis on Hazoor Multi Projects Share Forecast till 2030 – a lesser-known stock that has caught the eye of many retail investors due to its recent price movements and infrastructure focus.

What Do You Think?

Are you planning to Invest in NHPC for the long term?

Do you believe it can reach ₹200 or even ₹400+ by 2040?

Drop your thoughts in the comments – We’d love to hear your view!

NHPC Share Price Target – FAQs

Is NHPC a Good Stock to Buy for the Long Term?

Yes, NHPC is considered a strong long-term pick for conservative and dividend-focused investors. It offers stability, regular dividends, and exposure to India’s growing clean energy sector. However, it may not deliver fast gains like private-sector or penny stocks.

What is the NHPC Share Price Target 2025?

The NHPC share price target for 2025 is expected to be in the range of ₹88 to ₹105, depending on market conditions and the company’s performance in renewable expansion and government-backed projects.

What is the NHPC Share Price Target 2030?

By 2030, NHPC’s share price could potentially reach between ₹160 to ₹216, supported by continued investments in hydropower, solar, and pumped hydro storage projects. The target reflects both capital appreciation and consistent dividend payouts.

What is the NHPC Share Price Target 2040?

Looking at a long-term horizon, the NHPC share price target for 2040 is estimated to be in the range of ₹350 to ₹480. This forecast is based on India’s shift toward clean energy, NHPC’s project pipeline, and compounding investor interest.

Which are the Best PSU Stocks in India for 2025?

Apart from NHPC, some of the best PSU stocks in India for 2025 include:

IRFC – Infrastructure finance with consistent returns.

IREDA – Focused on renewable energy finance.

BEL – Defence sector PSU with strong fundamentals.

NTPC – Power generation giant with growth plans in green energy.

Note: Always do your own research or consult a financial advisor before investing.