Table of Contents

ToggleThe Rajendra Chodankar Story

Sometimes the most unbelievable stories come from the least expected places. One such story that’s caught the attention of investors across India is that of Rajendra Chodankar, the man behind RRP Semiconductor Ltd.

In just 18 months, his quiet holding in a small electronics company turned him into one of India’s newest billionaires — and it’s not because he won a lottery. His story shows the true power (and mystery) of the stock market, and what every beginner investor can learn from it.

The Man Everyone’s Talking About

Rajendra Chodankar isn’t a celebrity CEO or a social media figure. He’s a soft-spoken entrepreneur from Goa with a postgraduate degree in Inorganic Chemistry from Mumbai University.

He’s been associated with RRP Semiconductor, earlier known as G D Trading & Agencies, for years — quietly building and believing in the company when hardly anyone else did.

And then, something extraordinary happened.

The Meteoric Rise of RRP Semiconductor

You can check the real time RRP Semiconductor share price here.

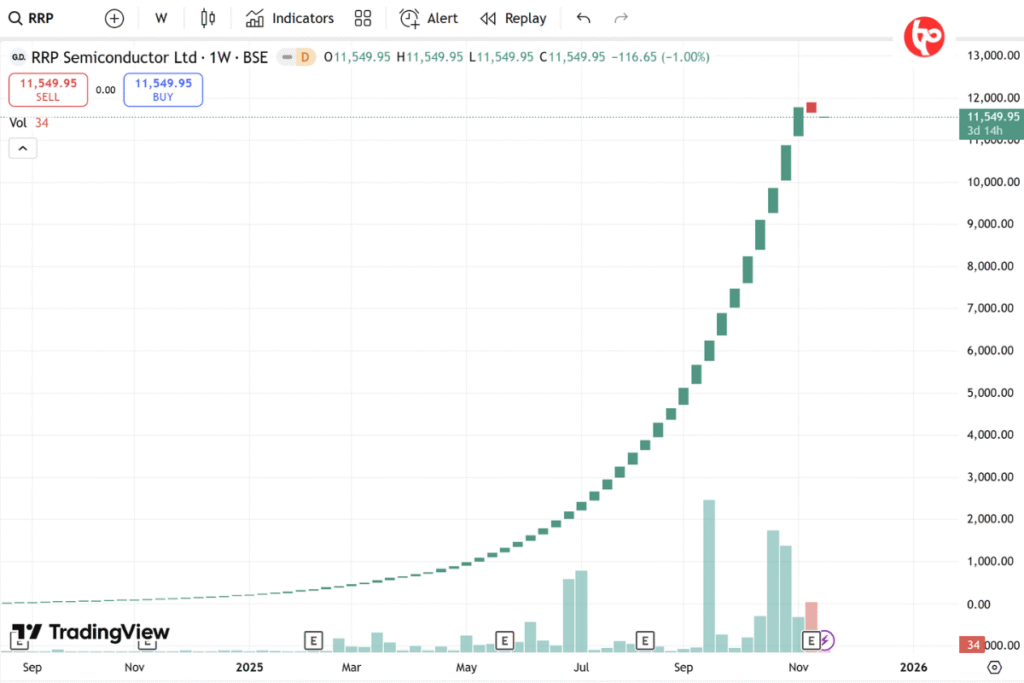

The company’s share price began its unbelievable rally, climbing more than 66,500% in less than two years.

To put that into perspective:

- A ₹10,000 investment would’ve become over ₹66 lakh.

- The stock price jumped from around ₹12 to above ₹10,000 per share.

With Rajendra Chodankar holding about 74.5% of the company’s shares, his net worth suddenly crossed ₹9,000 crore (around US $1 billion).

Overnight, India had a new stock market billionaire — and the investing world took notice.

But Wait — Is It All Real?

Here’s where the real investing lesson begins.

The company itself admitted that the sudden price surge wasn’t backed by a matching jump in revenues or profits.

In simple terms — the stock price was growing much faster than the business itself.

This kind of movement can happen when:

- Very few shares are available for trading (called low free float).

- Investors start buying aggressively, pushing prices up.

- Market sentiment, not fundamentals, drives valuation.

So, while Chodankar is technically a billionaire on paper, the sustainability of that valuation is uncertain.

The Bigger Lesson for Everyday Investors

Stories like Rajendra Chodankar’s are fascinating, but they also carry strong lessons for anyone dreaming of financial freedom through investing.

Here’s what his journey teaches us:

- Have a Vision

Chodankar didn’t sell his stake when things were quiet. He stayed invested, believing in his company’s potential.

That’s the first rule of wealth creation — long-term vision beats short-term emotion.

- Patience Pays

We often expect instant results from the market. But every successful investor knows — time in the market is more powerful than timing the market.

- Do Your Research

Don’t buy a stock just because it’s trending. Study the company, its products, management, and financials. Smart investing is about understanding, not guessing.

- Be Cautious with Hype

When prices skyrocket without solid earnings, it’s a signal to be careful, not to rush in.

Never invest based purely on headlines or hype.

- Start Small, Learn Big

Every successful investor started with curiosity and small steps. Even ₹500 or ₹1,000 invested monthly can grow significantly with consistency and learning.

Let’s Be Honest: Investing Is Emotional

Everyone loves success stories like Rajendra Chodankar’s — they make us dream. But it’s important to remember that investing is not gambling.

The stock market rewards knowledge, patience, and discipline — not luck.

Chodankar’s rise is inspiring, but the real takeaway isn’t about his billions.

It’s about understanding that your decisions today can shape your financial future tomorrow.

Key Takeaways

- Rajendra Chodankar became a billionaire because he believed and stayed invested in his company.

- The RRP Semiconductor rally shows how powerful — and unpredictable — the stock market can be.

- Beginners should focus on learning, researching, and investing regularly rather than chasing hot stocks.

Learn, Invest, and Grow

The world of investing is full of surprises. One day, an unknown entrepreneur becomes a billionaire; another day, a small investor makes their first successful trade.

Both moments matter — because they remind us that everyone starts somewhere.

So, if you’ve been waiting to begin your investing journey, let this story push you forward.

Start small. Learn continuously. Stay patient.

Who knows — your own story might inspire someone else someday.

What is the biggest lesson from Rajendra Chodankar’s story?

You don’t need crores to start—discipline, patience, and conviction can turn even small amounts into life-changing wealth.

His journey proves that long-term investing beats luck and short-term trading.

Did Rajendra Chodankar become a billionaire overnight?

No. His growth took years of persistence, smart decision-making, and disciplined investing. It was a gradual journey, not a lottery-style miracle.

What role did compounding play in his wealth creation?

A massive role. Compounding turned small investments into a fortune over time. His journey is a practical example of why long-term compounding is the world’s 8th wonder in investing.

Can beginners achieve similar success today?

Yes—if they adopt smart investing habits: learning about businesses, investing in quality stocks, avoiding shortcuts, and holding investments for years instead of months.

Can I become financially independent by investing like Rajendra Chodankar?

Absolutely. You may not reach billionaire status, but you can achieve financial freedom by:

Investing early

Staying consistent

Avoiding panic

Learning continuously

Focusing on long-term wealth creation