Table of Contents

ToggleLet’s begin the Journey

If you’ve ever caught yourself thinking,

“I wish I could invest, but I don’t know where to start,”

you’re not alone.

Almost everyone feels this way when they first hear words like shares, stocks, mutual funds, or compounding.

It sounds like a world built only for finance experts — not for someone earning a regular salary, running a small business, or just beginning their career.

But here’s the truth:

Investing isn’t just for the rich — it’s how ordinary people become rich.

It’s not about timing the market or finding shortcuts; it’s about starting early, staying consistent, and making smart choices.

Before starting, it’s helpful to understand how India regulates the investment ecosystem. The Securities and Exchange Board of India (SEBI) provides official investor education and protects investor rights.

A Familiar Beginning:

Imagine two friends — Raj and Meena — who start working at the age of 25.

- Raj believes in “saving for safety.” He keeps ₹5,000 every month in his savings account.

- Meena decides to “make her money work.” She invests the same ₹5,000 every month in a mutual fund averaging 12% returns.

Let’s fast-forward 20 years to see where they stand at age 45:

Person | Monthly Investment | Total Invested | Value After 20 Years | Growth |

Raj (Saver) | ₹5,000 | ₹12,00,000 | ₹12,00,000 | 0% |

Meena (Investor) | ₹5,000 | ₹12,00,000 | ₹49,95,000 | +315% |

The difference?

Meena let her money grow, while Raj’s money just sat idle.

And that’s the beauty of compounding — the silent force that builds wealth over time.

The Power of Compounding

Compounding is when your money starts earning returns on the returns it already made — like a snowball growing bigger as it rolls downhill.

Example:

If you invest ₹10,000 at 10% annual return:

- After 1 year → ₹11,000

- After 10 years → ₹25,937

- After 20 years → ₹67,275

You didn’t just double your money — you made it grow 6.7 times, without doing anything extra.

That’s the magic of time + patience = wealth.

Investing Is Not Gambling

One common fear beginners have is:

“What if I lose my money?”

That fear is valid — but it often comes from misunderstanding what investing truly means.

Gambling is based on luck.

Investing is based on research, discipline, and long-term thinking.

When you invest, you’re putting your money into productive systems — businesses, funds, or assets — that grow with the economy.

The risk exists, yes, but it’s measurable and manageable when you understand the basics.

You don’t need to predict the future — you just need to participate in it.

The real challenge isn’t that people don’t want to invest — it’s that they don’t know where to start or how to begin smartly.

Most of the content online feels too complicated, full of jargon, and disconnected from what beginners actually need.

That’s why this blog post walks you through everything step by step — in simple, practical, and layman language.

By the end of this blog, you’ll not just “know” investing — you’ll feel confident to take your first step.

Real-Life Reflection

Let me tell you another short story.

Ravi, a 28-year-old software engineer, always thought investing was risky.

He started late, at 33, after seeing his colleagues grow their wealth.

Even though he now invests ₹10,000 a month, he often says:

“If only I had started five years earlier, I could’ve retired five years sooner.”

This is a story most people relate to — they start when they realize they should’ve started years ago.

Your Money Deserves to Work as Hard as You Do

You work hard for your money every single day —

isn’t it time your money did the same for you?

Investing is not about chasing returns; it’s about building freedom, security, and choices for your future self.

It’s about making sure that 10, 20, or 30 years from now, you don’t have to work for money — your money works for you.

So let’s start your journey.

Grab a cup of chai , sit back, and let’s talk like friends about how to grow your wealth — one smart decision at a time.

Why You Should Invest?

Let’s start with a simple question: Why do people invest at all?

If you ask around, you’ll hear a dozen different answers —

“To get rich.”

“To beat inflation.”

“To save for retirement.”

“Because my friend told me to.” 😄

All of these are partly true, but the real reason is deeper:

We invest because we want control over our future — not uncertainty.

Let’s break this down and make it crystal clear with examples you’ll feel, not just read.

1. Saving Alone Isn’t Enough

Most of us grew up hearing this advice:

“Save money, and you’ll be safe.”

That was fine once upon a time.

But today, saving isn’t enough to grow your wealth — it only helps you “store” it.

Why? Because of one silent enemy: inflation.

Inflation: The Invisible Thief

Inflation is the gradual rise in prices of goods and services — meaning, your ₹100 today won’t buy the same things 10 years from now.

Let’s look at an example to understand this scenario:

- In 2010, 1 litre of milk cost ₹25.

- In 2025, the same litre costs ₹60.

That’s more than double!

If you had ₹1 lakh saved in 2010, and kept it idle in your savings account (earning around 3% interest),

your “real value” today is much less — because prices around you went up faster than your money grew.

So even though your balance increased, your buying power decreased.

That’s the real danger of not investing.

2.Compounding Rewards the Early Starters

You’ve already seen how compounding works in the introduction —

but here’s the part most people miss:

The earlier you start, the less money you need to invest to reach your goals.

Let’s see how timing alone changes the outcome:

Investor | Starts at Age | Monthly Investment | Average Return | Invests Till | Total Value |

Riya | 25 | ₹5,000 | 12% | 45 (20 years) | ₹49.9 lakh |

Sameer | 35 | ₹5,000 | 12% | 55 (20 years) | ₹49.9 lakh |

But if Sameer starts at 25 | — | ₹5,000 | 12% | 55 (30 years) | ₹1.76 crore |

Riya and Sameer invest the same amount for 20 years.

But when Sameer adds just 10 more years, the wealth grows 3.5x!

Moral:

You can’t control market returns, but you can control when you start.

And that’s the real secret to building wealth — start early, stay patient.

3. Your Goals Need Money, Not Just Hope

Everyone has goals — big or small:

- Buying your first home

- Sending kids to college

- Retiring comfortably

- Travelling the world

But goals are just dreams unless you give them a financial shape.

Here’s where investing bridges the gap between “someday” and “sooner”.

To make this clearer, let’s take an example.:

Let’s say you want ₹25 lakh for your child’s higher education in 15 years.

If you keep money in a savings account (3% return):

→ You’ll need to save about ₹11,800 every month.

But if you invest smartly (assuming 12% return):

→ You’ll only need to invest ₹6,200 per month.

That’s half the effort for the same result — all because you made your money work harder.

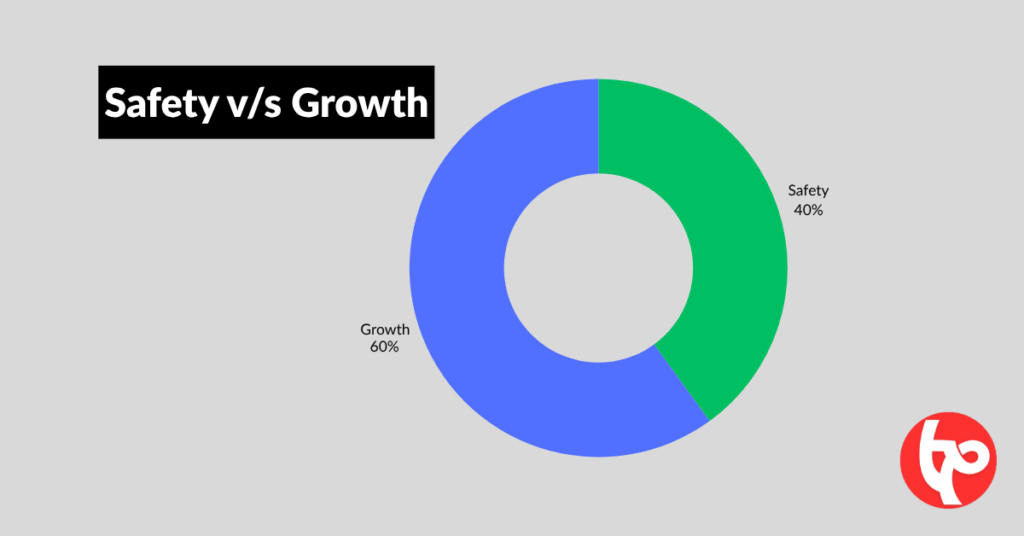

4. Investing Balances Risk and Reward

There’s a misconception that investing means taking big risks.

In reality, you can choose your own comfort zone — from super-safe to aggressive.

Let’s compare:

Type | Example | Risk | Average Return | Suitable For |

Safe | Bank FD, PPF | Low | 6–8% | Stability seekers |

Moderate | Mutual Funds, Index Funds | Medium | 10–14% | Balanced investors |

Aggressive | Stocks, Equity Funds | High | 12–20% | Long-term growth seekers |

When you understand how each investment works, you can build a mix —

some safe, some growth-oriented — so your money grows without sleepless nights.

Example:

If you invest ₹10,000 a month —

- ₹4,000 in safe assets (PPF, FD)

- ₹6,000 in growth assets (mutual funds, stocks)

→ you reduce overall risk while still compounding wealth.

That’s called diversification, and it’s your best friend in uncertain markets.

5. Financial Independence Means Freedom

At the heart of investing lies one simple goal — freedom.

Freedom to:

- Quit a job you dislike

- Take a break without guilt

- Help your parents without stress

- Start something of your own

- Sleep peacefully knowing your future is secure

Example:

Meet Neha, a teacher who started investing ₹8,000/month in mutual funds at 27.

Now, at 40, her portfolio is worth ₹32 lakh.

She says,

“I don’t worry about retirement anymore — I’m planning my travel bucket list instead.”

That’s what real financial independence looks like — peace of mind, not just numbers in a bank.

6.Because the Earlier You Learn, the Better You Play

Let’s face it — schools taught us algebra and trigonometry, but not money management.

We learned how to earn, but not how to grow or protect it.

The good news?

It’s never too late to start — but the earlier you do, the easier life becomes later.

Example:

Think of investing like planting a mango tree.

The best time was 10 years ago.

The second-best time? Today.

If you plant the seed today, you might wait a few years for fruit —

but once it grows, it’ll feed you for decades.

That’s the magic of consistency in investing.

7. Wealth Creation Is a Journey, Not a Race

Everyone’s path looks different.

Some start at 22, some at 40.

Some invest ₹2,000 a month, others ₹20,000.

And that’s okay.

The key is not how fast you go, but how long you stay.

If you drive steadily for 20 years, you’ll reach further than someone who speeds for 2 and quits after a crash.

Markets work the same way — discipline beats excitement.

In Short

You should invest because:

- Inflation silently eats your savings.

- Compounding multiplies your patience.

- Your dreams need funding, not wishing.

- Risk is manageable with smart planning.

- Freedom is built through consistency.

Final Thought Before We Move On

“You can make money only two ways —

work for it, or make it work for you.”

When you start investing, you give every rupee a job.

And over time, those rupees bring friends back with interest 😄.

Understanding Different Types of Investments

When people hear the word “investment”, they usually think of the stock market.

But in reality, the investment world is a buffet — full of different dishes, each with its own flavor, spice, and aftertaste .

Some are light and safe, while others are fiery and risky.

The smart investor? They know how much of each dish to take on their plate.

Let’s explore the main types of investments available to an everyday investor in India — along with examples, pros, cons, and when to use them.

Bank Fixed Deposits (FDs) — The Safe Starter

This is where most Indians begin.

FDs are like your safety blanket — they give you peace of mind, but not much excitement.

How it works:

You deposit a fixed amount of money for a fixed period (say 1–5 years), and the bank pays you a fixed interest (usually 6–7% per annum).

Example:

You invest ₹1 lakh for 3 years at 7% interest.

At the end, you’ll get around ₹1.23 lakh — no surprises, no risks.

Pros:

- 100% predictable and safe

- Easy to start from your bank account

- Suitable for short-term goals

Cons:

- Returns often lower than inflation

- Tax on interest income

- Money locked-in till maturity

When to invest:

If you’re new to investing or saving for short-term needs (like a trip or emergency fund), FDs are a good start.

Shares & Stocks

The stock market is a platform where companies raise money and investors participate in ownership. To understand how indexes, returns, and benchmarks work, you can refer to the National Stock Exchange (NSE) official Nifty 50 index methodology.

When you buy a stock, you literally own a part of that company.

If the company grows, your money grows too.

Think of it like this:

Buying one share of Infosys makes you a tiny shareholder of Infosys itself — a part-owner of a billion-dollar enterprise.

Example:

If you bought 100 shares of Infosys at ₹1,000 each in 2013 (₹1 lakh total), by 2025, your investment would be worth around ₹2.8 lakh — almost 3x your money, not including dividends.

Pros:

- High potential returns

- Dividends + capital appreciation

- Liquidity — you can buy/sell anytime

Cons:

- Volatile in the short term

- Requires research and patience

- Emotional decisions can hurt returns

When to invest:

If you can stay invested for 5+ years and can handle ups and downs, stocks are your long-term wealth creators.

Mini Tip:

Start small — pick companies you understand.

If you use Zomato daily, try reading about its financials and story. Investing becomes easier when you relate to the business.

Mutual Funds

If picking individual stocks feels too complex, mutual funds are your next best friend.

Here, professionals manage your money by pooling it with others and investing in multiple stocks or bonds.

Example:

You invest ₹5,000 per month in a mutual fund SIP (Systematic Investment Plan).

Over 15 years, with a 12% average return, that grows to ₹25 lakh — thanks to compounding and consistency.

Pros:

- Diversification (you own parts of 30–100 companies)

- Managed by experts

- Easy to start SIPs from ₹500/month

Cons:

- Management fees (small but real)

- Returns not guaranteed

- Some funds perform better than others

When to invest:

Ideal for beginners aiming for long-term goals like home purchase, kids’ education, or retirement.

An example will help clarify this scenario:

The HDFC Flexi Cap Fund has given over 14% CAGR since inception — which means ₹1 lakh invested 10 years ago is now worth ₹3.7 lakh.

Gold — The Time-Tested Safe Haven

Indians love gold — and not just for weddings!

It’s been a symbol of security and wealth preservation for centuries.

But you don’t need to buy jewelry to invest in gold anymore — there are smarter options like Gold ETFs and digital gold.

Example:

From 2013 to 2023, gold prices rose from ₹27,000 to ₹60,000 per 10 grams — a CAGR of around 8%.

Not spectacular, but solid protection during market crashes.

Pros:

- Hedge against inflation and currency risk

- Easy to buy/sell

- Works well in economic uncertainty

Cons:

- No regular income

- Returns lower than equities over time

When to invest:

Use gold as a stabilizer — 5–10% of your portfolio to balance market risk.

Real Estate

Owning property is the dream of many — a home you can see, touch, and live in.

Real estate can be both a consumption asset (your home) and an investment asset (a rented or resold property).

Example:

A flat bought for ₹40 lakh in 2010 could be worth ₹1.2 crore today — roughly 7–8% annual appreciation, plus rent income.

Pros:

- Tangible and stable

- Potential rental income

- Hedge against inflation

Cons:

- Requires large capital

- Low liquidity

- Maintenance and legal risks

When to invest:

For long-term wealth preservation, or if you seek rental income.

But don’t lock all your money here — balance with liquid investments.

Bonds and Debt Instruments

If stocks are the roller coaster , bonds are the train — slower, steadier, and predictable.

When you buy a bond, you’re lending money to a government or company.

They pay you regular interest and return your principal at maturity.

Example:

You invest ₹1 lakh in a government bond paying 7.5% for 5 years.

You get ₹7,500 per year as interest — guaranteed.

Pros:

- Stable income

- Safer than equities

- Great for balancing portfolios

Cons:

- Lower returns than equities

- Some corporate bonds carry credit risk

When to invest:

Best for conservative investors or retirees looking for regular income.

New-Age Investments — Crypto, REITs, ETFs, and Beyond

Welcome to the modern investing playground .

Here you’ll find digital assets, fractional real estate, and innovative products built for tech-savvy investors.

🔹 Crypto (Bitcoin, Ethereum, etc.)

Digital currencies based on blockchain.

High reward but very high risk.

Example:

Bitcoin went from ₹30,000 in 2013 to over ₹50 lakh in 2025 — but also dropped 70% multiple times in between.

🔹 REITs (Real Estate Investment Trusts)

You invest in property portfolios — malls, offices, etc. — and earn rental income as dividends.

A great way to get real estate exposure without buying property.

🔹 ETFs (Exchange Traded Funds)

These track indexes like the Sensex or Nifty 50 — giving you broad market exposure at low cost.

Pros (for new-age options):

- Innovative and flexible

- Lower entry barriers

- Great for diversification

Cons:

- Market-linked risk

- Requires awareness and caution

Comparing All Investment Types

Investment Type | Risk | Return (p.a.) | Liquidity | Suitable For |

Bank FD | Low | 6–7% | High | Short-term stability |

Mutual Funds | Medium | 10–14% | High | Long-term goals |

Stocks | High | 12–20% | Very High | Growth seekers |

Bonds | Low-Medium | 7–9% | Medium | Regular income |

Gold | Low-Medium | 7–8% | High | Safety & diversification |

Real Estate | Medium | 7–10% | Low | Wealth building |

Crypto / New-age | Very High | Variable | High | Risk-takers |

Final Thought Before Moving On

“There’s no single ‘best investment.’

The best one is the one that fits your goal, your timeline, and your comfort.”

In the next section, we’ll discuss how to actually build your first investment plan — setting goals, choosing asset mix, and starting small but smart.

Building Your First Investment Plan

Now that you understand the “why” and “what” of investing, it’s time to tackle the most exciting part —

how to actually start building your first investment plan.

Think of it like setting off on a road trip.

You don’t just start driving — you check your destination, fuel level, route, and timing.

Similarly, an investment plan helps you answer:

- Where am I going financially?

- How much can I invest?

- What’s the right mix of investments for me?

Let’s break this down, step-by-step, so you can confidently build your own roadmap to financial growth.

Define Your Financial Goals Clearly

Before investing a single rupee, you need to know why you’re investing.

Goals give direction.

They tell your money what job to do — otherwise, it just sits around lazily. 😄

Consider this Example 1: Let’s Meet Arjun

Arjun, a 27-year-old marketing executive, decides to start investing ₹10,000 every month.

When asked why, he says,

“Just to save for the future.”

That sounds noble, but it’s too vague.

Now compare this to:

“I want ₹5 lakh for a Europe trip in 4 years, ₹20 lakh for a home down payment in 8 years, and ₹1 crore for retirement in 30 years.”

Suddenly, Arjun’s goals are clear.

Each has a timeline and a target amount — the foundation of a solid investment plan.

Types of Goals

Type | Example | Time Frame | Recommended Investment Type |

Short-Term | Buy a bike, vacation, emergency fund | < 3 years | Bank FD, Liquid Mutual Fund |

Medium-Term | Home down payment, car, higher studies | 3–7 years | Hybrid / Debt Funds, Gold |

Long-Term | Retirement, child’s education, wealth creation | 7+ years | Equity Mutual Funds, Stocks, REITs |

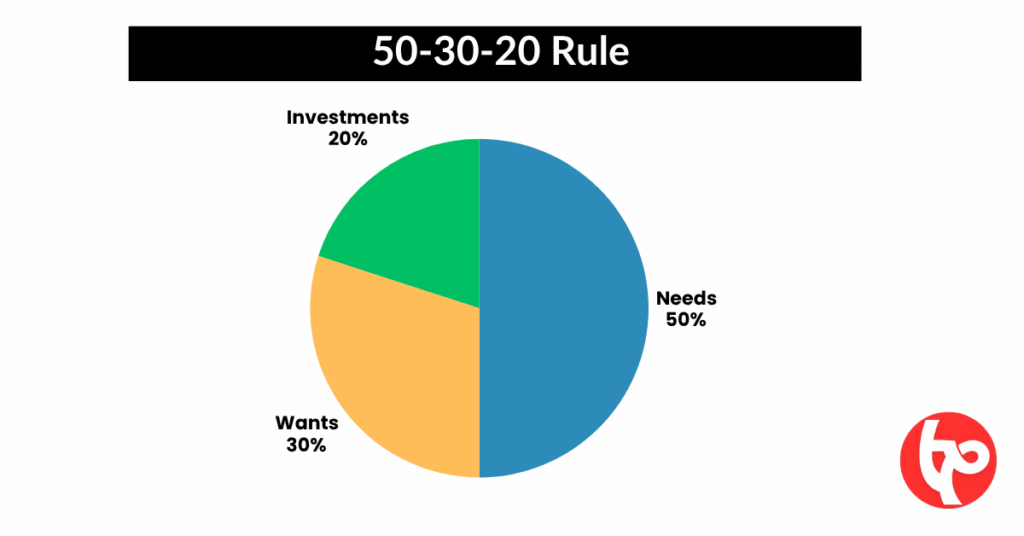

Analyze Your Current Financial Situation

Before deciding how much to invest, take stock of your current finances — just like a doctor runs diagnostics before prescribing medicine.

You need to know:

- How much you earn monthly

- How much you spend

- How much you save

- How much debt you have

Suppose your monthly income is ₹60,000.

You spend ₹40,000 on essentials and ₹5,000 on discretionary items.

That leaves ₹15,000 in savings potential — your investable surplus.

But if you have an EMI of ₹8,000, you should ideally invest ₹6,000 and keep ₹1,000 aside for emergencies.

Use the 50-30-20 rule:

- 50% for needs

- 30% for wants

- 20% for savings/investments

This simple rule keeps your finances balanced while ensuring consistent investing.

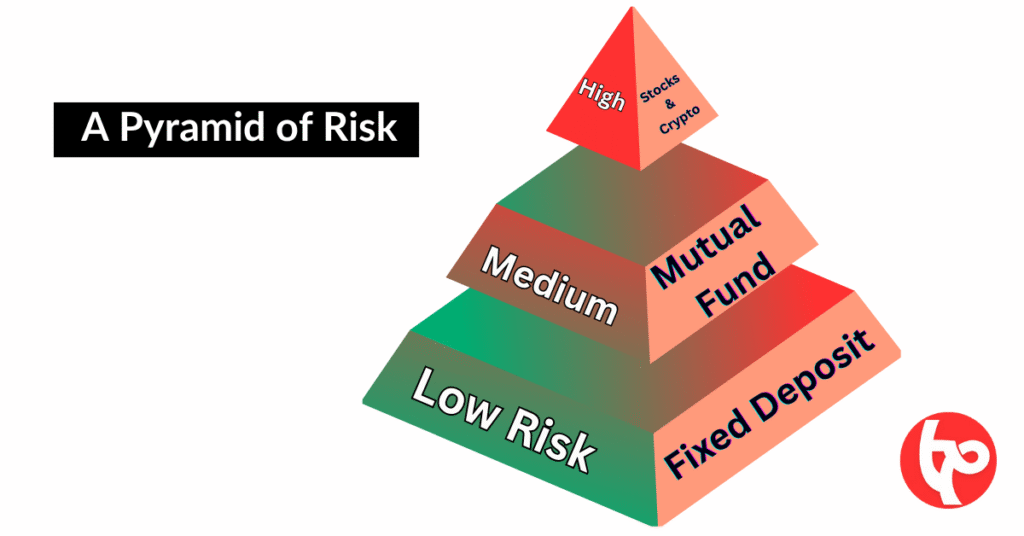

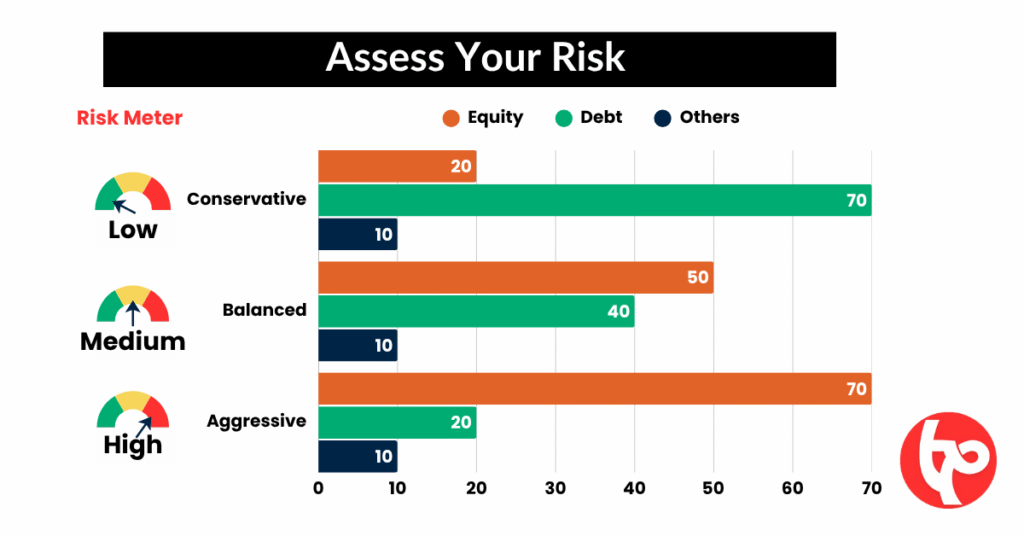

Decide Your Risk Appetite

Everyone talks about returns, but real investors first understand risk.

Risk appetite means — how much fluctuation in value can you handle without losing sleep at night?

Let’s break this down with an example

Rina vs. Karan

- Rina (28): Just started working, no major responsibilities.

She can take high risk → invests mostly in equity mutual funds. - Karan (40): Has a family, home loan, and school expenses.

He prefers low-risk → more focus on debt funds and gold.

How to Assess Your Risk Appetite

Profile | Description | Suggested Allocation (Equity : Debt : Others) |

Conservative | Prioritizes safety, dislikes volatility | 20 : 70 : 10 |

Balanced | Open to moderate ups and downs | 50 : 40 : 10 |

Aggressive | Comfortable with market swings for higher returns | 70 : 20 : 10 |

Allocate Assets Smartly

Asset allocation is the backbone of investing.

It means deciding how much money to put into different investment types — like stocks, bonds, gold, etc.

A great investor once said:

“Don’t put all your eggs in one basket — but don’t scatter them in every field either.”

A simple thumb rule: 100 – Your Age = % of Portfolio in Equities

So if you’re 30, you could keep ~70% in equities (stocks/mutual funds) and 30% in debt (FDs, bonds, etc.).

As you age, gradually reduce risk.

Remember Meena (from our earlier story)? She is 25.

She invests ₹5,000 monthly:

- ₹3,500 in mutual funds (equity)

- ₹1,000 in debt fund

- ₹500 in gold ETF

That’s 70-20-10 — a simple, balanced mix for her age and goals.

Start Small but Stay Consistent

Many people wait until they “have enough money” to start investing.

But waiting is the biggest cost.

Start with what you can — even ₹500 a month matters.

It’s not about the amount; it’s about consistency and compounding.

A ₹1,000 SIP growing at 12% per year becomes:

- ₹2 lakh in 10 years

- ₹10 lakh in 25 years

That’s the power of staying invested.

Useful Tip:

Automate your SIPs on salary day. Treat investing as a non-negotiable bill to your future self.

Avoid Common Mistakes

New investors often trip on the same stones.

Mistake | Why It’s Dangerous | Fix |

Chasing “hot tips” | Emotion > logic = loss | Invest based on research, not rumors |

Timing the market | Impossible consistently | Time in the market beats timing |

Ignoring diversification | Concentrated risk | Mix assets wisely |

Withdrawing early | Miss compounding | Stay patient |

No emergency fund | Forced selling during need | Keep 3–6 months’ expenses in liquid fund |

Create Your First Investment Plan Template

Here’s a simple structure you can actually use:

Goal | Time Frame | Monthly Investment | Investment Type | Expected Return | Notes |

Emergency Fund | 1 year | ₹5,000 | Liquid Fund | 6% | 3–6 months’ expenses |

Europe Trip | 4 years | ₹8,000 | Hybrid MF | 9% | Medium risk |

Retirement | 30 years | ₹10,000 | Equity MF | 12% | Start SIP |

Key Takeaway

“An investment plan isn’t a one-time document — it’s a living roadmap.

Review it every year, adjust as your life changes, and stay focused on the big picture.”

This is where most people stop — but real investors go one step further.

They learn to measure performance, rebalance portfolios, and upgrade their knowledge consistently.

That’s exactly what we’ll cover next:

How to Track, Review, and Improve Your Investments Over Time

If you’ve made it this far, you’ve already done something 90% of people never do — you’ve started your investment journey.

But here’s the truth most beginners miss:

Investing isn’t a one-time event — it’s a lifelong relationship with your money.

You don’t just “set it and forget it.”

You nurture it, check its progress, fix it when it goes off track, and grow smarter every year.

Let me tell you a short story to make this real.

Riya vs. Aman — The Tale of Two Investors

Riya and Aman both began investing ₹10,000 every month in mutual funds.

- Riya treated investing like a chore she could tick off once. She set up her SIPs and never looked back.

- Aman, on the other hand, made it a habit to review his portfolio every 6 months.

After 5 years, here’s what happened:

- Riya’s SIPs were still running — but half of them had underperformed because the fund manager’s strategy changed.

- Aman’s portfolio, meanwhile, grew 25% more. Why? Because he switched poor performers, rebalanced his mix, and even increased his SIPs when his salary grew.

Tracking and reviewing doesn’t just protect your money — it multiplies it.

Why Tracking Matters

Imagine driving a car without a dashboard.

You wouldn’t know your speed, fuel level, or direction — until something goes wrong.

That’s exactly what happens when you invest and never track.

Tracking your investments helps you:

- Know if you’re on track to meet your goals.

- See what’s performing and what’s not.

- Identify when to adjust your plan — before small issues become big problems.

And guess what? You don’t need to be a finance geek to do it.

You just need a simple system.

How to Track Your Investments

Let’s break this into two easy ways:

If you like doing things your way, create a sheet with:

Date | Investment Type | Amount | Current Value | Returns (%) | Notes |

Jan 2024 | SIP (Axis Bluechip Fund) | ₹10,000 | ₹12,000 | 20% | Continue |

Jan 2024 | Gold ETF | ₹5,000 | ₹5,400 | 8% | Stable |

You can update this monthly or quarterly to see your performance.

If you prefer automation, apps like:

- INDmoney

- ET Money

- Groww

- MoneyControl Portfolio Tracker

…can automatically fetch your mutual funds, stocks, and crypto data — and show total growth, asset allocation, and even tax reports.

Example:

Aman used INDmoney, and within 6 months, he realized 60% of his portfolio was in one sector — IT.

By rebalancing to include banking and pharma funds, he reduced risk and improved long-term returns.

How to Review Performance

Once you track, the next step is reviewing your portfolio — just like an annual health check-up.

What to Review:

- Goal alignment:

Are your investments still helping you achieve your original goals (house, retirement, education)? - Returns vs. Benchmark:

Compare your fund’s return with its benchmark or peers.

Example: If your large-cap fund gives 9% but the Nifty 100 gives 13%, your fund is underperforming. - Expense ratio:

High costs eat into returns. Prefer funds with lower expense ratios. - Risk exposure:

Is your portfolio too heavy on one sector or asset class? - Fund management changes:

A change in fund manager or strategy could affect performance.

The Annual Review That Saved ₹1 Lakh

Every January, Aman reviewed his portfolio. In one such review, he noticed one of his funds’ returns fell from 12% to 5% — while peers gave 11–13%.

He switched that SIP to a better-performing fund. Over the next 3 years, that small change helped him earn ₹1 lakh more.

That’s the power of simple, consistent reviews.

The Importance of Rebalancing

When you first start investing, you might decide a mix — say 70% equity, 30% debt.

But markets move.

A long bull run could push your equity portion to 85%, increasing risk without you noticing.

Or a market crash could drop it to 55%, slowing growth.

That’s where rebalancing comes in — bringing your portfolio back to your desired ratio.

Example:

Let’s say you invested ₹10 lakh — ₹7 lakh in stocks, ₹3 lakh in debt.

After a year:

- Stocks grow 20% → ₹8.4 lakh

- Debt grows 6% → ₹3.18 lakh

- Total = ₹11.58 lakh

Now, equity = 72.5% and debt = 27.5%.

You can rebalance by:

- Selling some equity and moving it to debt, or

- Investing new money in debt to restore the 70:30 ratio.

Key Idea:

Rebalancing helps you “buy low and sell high” naturally — without trying to time the market.

How to Continuously Improve as an Investor

The most successful investors share one secret:

They never stop learning.

Even Warren Buffett spends hours reading every day. Why? Because markets evolve — and your understanding should too.

Here’s how you can do it:

- Read regularly: Books like The Psychology of Money, Rich Dad Poor Dad, or blogs (like Target Prices ).

- Follow credible YouTube or podcasts: Learn from voices who simplify finance, not sensationalize it.

- Join communities: LinkedIn groups, Reddit investing forums, or your own “Target Prices” community can offer insights.

- Reflect on mistakes:

Everyone makes them — what matters is learning faster than others.

Riya, from our earlier story, learned after her first 5 years.

She started reading and reviewing — and within 2 more years, she outperformed Aman!

It’s never too late to start improving.

Key Takeaway

“Tracking is like getting regular health checkups for your money — it tells you what’s working, what’s weak, and what needs attention.”

Investing success doesn’t depend on how much you know at the start — it depends on how much you adapt and improve over time.

So if you’ve read this far — pat yourself on the back

You’re no longer a beginner; you’re on your way to becoming a confident, self-aware investor.

Common Mistakes New Investors Make (and How to Avoid Them)

If investing were only about numbers, everyone would be rich.

But in reality — it’s behavior, not brilliance, that separates successful investors from the rest.

Even smart people fall into traps like panic-selling, chasing hype, or ignoring diversification.

And the sad part? Most of these mistakes are totally avoidable once you’re aware of them.

Let’s explore the most common ones — and how you can steer clear

Chasing Quick Returns

We’ve all seen it — a friend posts a 40% crypto gain on Instagram, or a news channel hypes the “next multibagger stock.”

It’s tempting to jump in.

But here’s the truth:

Fast money is fragile money.

Meet Rohit, Who saw a “hot tip” about a small-cap stock trending online.

He invested ₹50,000 — and within 2 months, it crashed by 60%.

Had he put that into a solid index fund, he’d have quietly earned 10–12% annually.

What to Do Instead:

Focus on consistent compounding, not quick profits.

Follow a goal-based approach — invest for your why, not for FOMO (Fear of Missing Out).

Not Diversifying Investments

Putting all your money in one asset is like putting all your eggs in one basket — and then running with it on a rainy day.

Meet Meena, She invested all her money in real estate in 2019.

When COVID hit, property prices stagnated, and she couldn’t sell.

Her friend Nisha had a balanced mix — 50% equity, 30% debt, 20% gold — and her portfolio still grew 8% that year.

What to Do Instead:

Diversify across asset classes (equity, debt, gold, real estate) and even within them.

Diversification doesn’t eliminate risk — but it cushions the fall when one sector fails.

Ignoring Risk & Emergency Funds

Most beginners invest everything they have — leaving no room for emergencies.

Then, when life throws a curveball (like a medical bill or job loss), they end up selling investments at a loss.

Ankit started investing aggressively at 22.

But when his laptop broke and he needed ₹60,000, he had to withdraw from his ELSS fund — paying exit load and taxes.

What to Do Instead:

Before you invest, build an emergency fund with 3–6 months’ expenses.

Keep it in a liquid mutual fund or high-interest savings account.

This gives you peace of mind and protects your long-term investments.

Timing the Market

Trying to predict when to buy or sell is a losing game — even for professionals.

Example:

Between 2008 and 2020, if you missed just the 10 best days in the stock market, your total returns could drop by more than 40%!

That’s how brutal market timing can be.

What to Do Instead:

Use SIPs (Systematic Investment Plans) to average out market ups and downs.

Stay consistent — markets reward patience, not prediction.

Not Reviewing or Rebalancing

Remember our friends Riya and Aman from earlier?

Riya ignored her investments for years — and underperformed.

Aman tracked and rebalanced — and grew wealth faster.

Neglecting to review your portfolio is like buying a car and never servicing it.

Eventually, it breaks down.

What to Do Instead:

- Review annually or bi-annually.

- Rebalance to maintain your desired mix (like 70% equity / 30% debt).

- Replace underperforming funds or assets wisely, not impulsively.

Following the Crowd

Investing based on what others are doing — or what’s trending on social media — rarely ends well.

Example:

Remember when everyone rushed into Dogecoin in 2021?

Many who entered late lost more than 80% of their value.

What to Do Instead:

Do your own research.

Understand why you’re investing — not because someone else is.

Your goals, income, and risk tolerance are unique — your portfolio should be too.

Not Understanding What You’re Investing In

Many beginners buy mutual funds or stocks without even reading what they are.

They treat investing like gambling — not decision-making.

Example:

Pooja bought a “sector fund” because it had 25% returns last year — not realizing it was heavily exposed to oil prices.

When oil prices fell, her fund tanked.

What to Do Instead:

Invest only in things you understand.

If you can’t explain how it works in one line, don’t put money in it.

Getting Emotional

Fear and greed are the biggest enemies of investors.

- Markets rise → greed → overinvesting

- Markets fall → fear → panic selling

During the 2020 crash, millions sold their mutual funds in panic.

Those who stayed invested saw their wealth double by 2022.

What to Do Instead:

Follow your plan, not your mood.

Investing is emotional discipline — not emotional reaction.

Your Journey Toward Financial Freedom

You’ve now walked through every step of the investing journey —

from understanding why to invest, to how to start, what to choose, how to track, and what to avoid.

Let’s pause for a moment and reflect.

You don’t have to become an overnight expert.

You just need to:

- Start early (even ₹500/month matters)

- Stay consistent (time > timing)

- Keep learning (your best investment is knowledge)

“The best time to plant a tree was 20 years ago. The second-best time is today.”

The same goes for investing.

Start small, stay curious, and grow confident — because your financial future deserves your attention today.

Where to Go Next

Here’s how we’ll keep your learning alive:

- Read next: Types of Investment Options Explained (Stocks, Mutual Funds, Crypto, and More)

- Also explore: How to Manage Financial Risks and Diversify Like a Pro

- Coming soon: Investor Psychology — How Emotions Impact Your Money Decisions